Insight into AI trends in the communications industry

the application of AI in the communication industry is deepening, especially in the context of the rise of Generative AI. The communications industry is using AI technology to optimize customer experience, automate processes, improve productivity, and improve network operations. In order to compile the second edition of the communication industry AI status report, NVIDIA conducted a survey of more than 400 communication industry professionals around the world, understand their views on the opportunities and challenges faced by deploying AI in enterprises and industries. The report focuses on the key survey results of the current AI situation in the communications industry in 2024.

Research shows that the application of AI, especially the application of generative AI, is accelerating its popularization, and the enthusiasm of senior managers for AI is obviously high. In addition, compared with last year, the communication industry has a clearer understanding of AI positioning, AI application scenarios continue to expand, and the understanding of AI return on investment (ROI) is deeper. Although investment in AI is increasing, the industry is still at the initial stage of the AI investment cycle.

First-line insight

this report focuses on the views of communication professionals responsible for deploying and delivering AI (including generative AI) in actual business. The report summarizes the survey results from October to December 2023. The survey covered more than 400 interviewees who quantitatively evaluated the opportunities and challenges for their respective enterprises to adopt AI. The report also includes insights into how the industry promotes the implementation of AI and the role of partners in AI solutions in the communications industry.

Respondents covered a variety of communication enterprises (including mobile, fixed network and cable operators) and their hardware and software suppliers. They come from different departments, including customer service, marketing and business development. The survey results also include feedback from management professionals (including senior managers).

Major insights into AI in the communications industry

opportunities and Challenges- expectations for AI success continue to rise.

- The communications industry has fully embraced the generation AI wave.

- Improving customer experience is the greatest opportunity.

- AI is driving revenue growth and cost optimization at the same time.

- Lack of skills is a major obstacle to AI adoption and deployment.

- AI investment shows an increasing trend, but the overall level is still low.

- Customer experience-related fields have attracted the highest proportion of AI investment.

- Expanding from pilot to full deployment is the primary factor in promoting AI investment.

- hybrid hosting is the preferred solution, but the adoption rate of cloud hosting is increasing.

- Partnerships remain crucial in the application of industry AI solutions.

Opportunities and Challenges

expectations for AI success continue to rise

the enthusiasm for AI adoption in the communications industry continues to rise, especially among top managers in the industry, the expectation of AI success continues to rise. According to the survey in 2023, 90% of the respondents said they were currently participating in AI-related work, whether in the evaluation/pilot stage or the implementation/use stage. This continuous participation indicates that AI is successfully penetrating multiple links of the communication value chain.

Which stage was your company using AI in 2023?- 10% not used

- 48% in evaluation/pilot phase

- 41% in the implementation/use phase

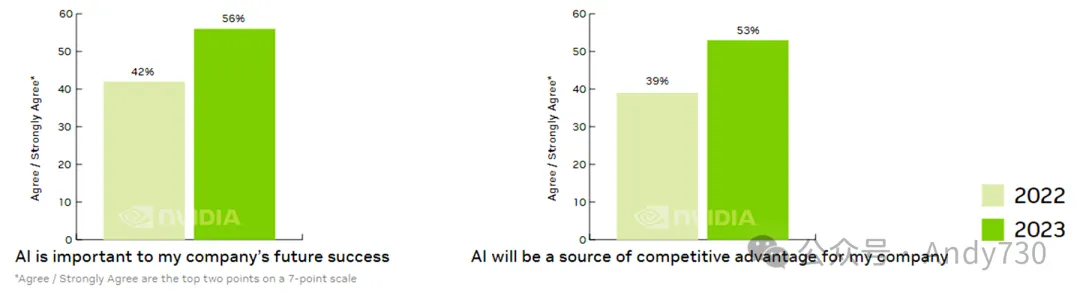

the main reason for this continuous participation is that many industry stakeholders believe that AI can make important contributions to the success of enterprises. Overall, 56% of the interviewees agree or strongly agree with the statement that "AI is crucial to the future success of our company", while among the managers at the decision-making level, the proportion is as high as 61%. Compared with the 42% result in 2022, this is a significant 14 percent age point increase.

This improvement in cognition reflects that the industry generally believes that the adoption of AI will bring market competitive advantages to enterprises, which is especially important for the highly competitive communication industry. In the survey in 2023, 53% of the interviewees agreed or strongly agreed that adopting AI would become the source of competitive advantage, while only 39% held the same view in 2022. Among the management interviewees, the proportion is as high as 56%.

However, not everyone agrees with the importance of AI in the industry. Some interviewees with different opinions pointed out that all stakeholders need to make further efforts to demonstrate how AI can solve practical business problems in the industry.

Benefits and prospects of AI

the communication industry has fully embraced the generation AI wave.

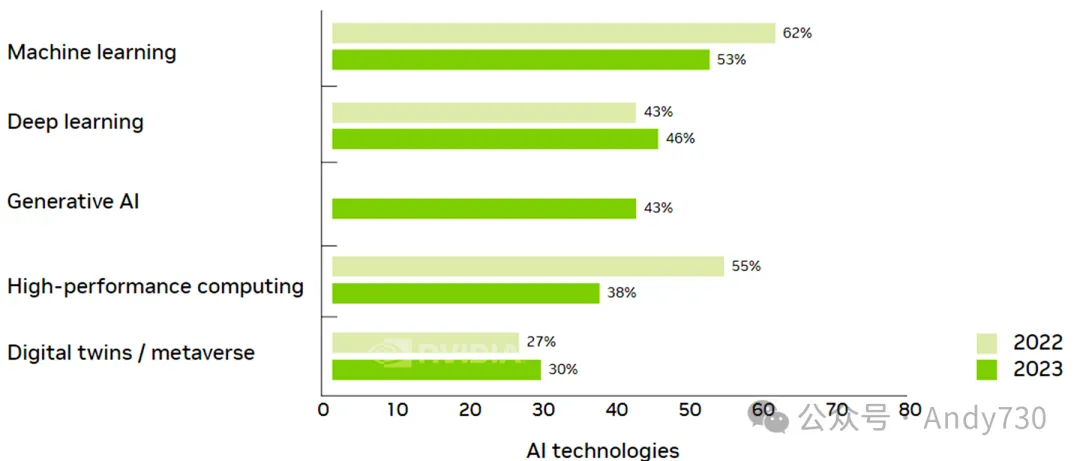

Obviously, Large Language Models (LLMs) are the most concerned AI technologies this year. Although generative AI was not mentioned in the survey in 2022, the survey in 2023 showed that 43% of the respondents said they were investing in this field, it clearly shows that the communication industry is actively embracing the generation AI wave to meet various business needs.

Generative AI has shown great potential in many fields of the value chain of the communication industry. Among those interviewees who are investing in AI, 57% use generative AI to improve customer service and support, 57% use AI to improve employee productivity, and 48% use AI to operate and manage networks, 40% is used for network planning and design, and 32% is used for generating marketing content.

In addition to application scenarios, the survey also revealed how the industry developed and deployed LLM models for generative AI. About 40% of the interviewees use their own data to train internal AI models, and then use these models to enhance existing solutions; 29% of the interviewees build or customize models together with their partners. Similarly, 40% of the respondents preferred on-premises deployment, while 37% believed that low latency and output speed were crucial to them.

In which areas does your company invest in AI?

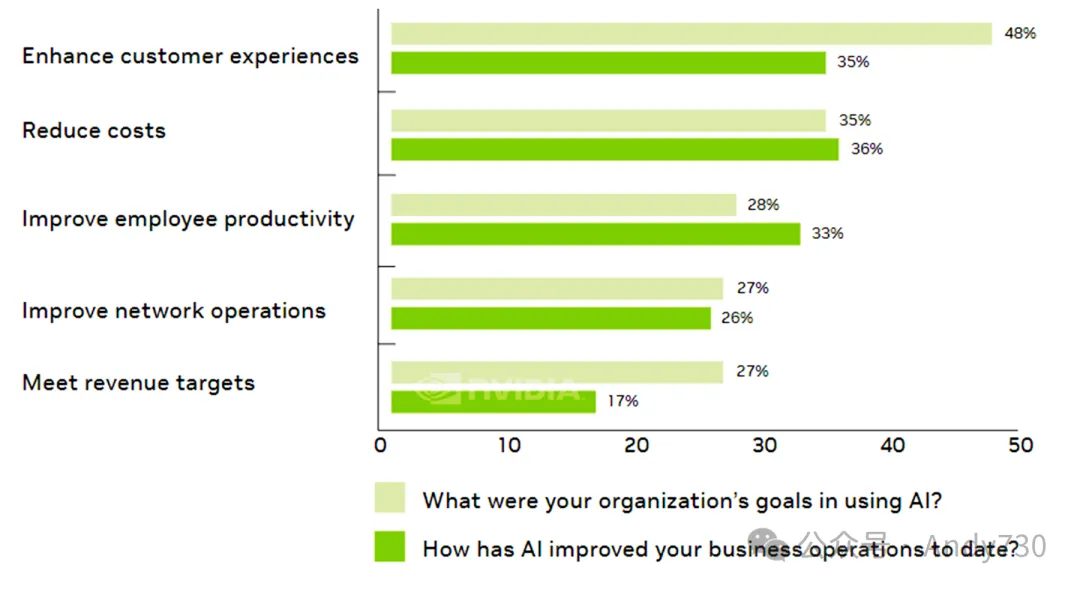

Improving customer experience is the greatest opportunity

improving customer experience is the greatest opportunity for AI applications in the communications industry. In this survey, 48% of the interviewees regard it as the primary goal of using AI, while in terms of generative AI, the proportion is as high as 57%. 35% of the interviewees believe that customer experience is a key success case for their AI applications.

Communication companies are improving customer interaction through a variety of solutions, such as virtual assistants, rich retail experience, personalized recommend, and customer churn management. This trend is understandable in industries with more than 5 billion customers worldwide and the customer churn rate is a key indicator to measure the performance of telecom operators. Other clear opportunities include using AI to reduce costs, improve employee productivity, and improve network operations.

What strategic goals do you want to achieve through AI?

AI is promoting revenue growth and cost optimization at the same time

for industry stakeholders, the ultimate goal of AI application is to increase revenue or reduce costs. Among all the interviewees, 67% said that AI applications helped them increase their income, and 19% of them pointed out that their income increased by more than 10%. Among the interviewees who are at least in the experimental or pilot phase, 71% said that AI applications have driven revenue growth in specific business areas.

There is a similar trend in cost. Among all the interviewees, 63% said that AI applications have helped them reduce costs in specific business areas, and 14% of the interviewees mentioned that costs have been reduced by more than 10%. Among the interviewees in the experimental or pilot phase, 66% said that AI applications helped them achieve cost optimization.

This trend of income growth and cost reduction, for the communication industry facing huge pressure of Capital Expenditure (CAPEX) and Operating Expenditure (OPEX) at the same time, it is undoubtedly a positive signal, especially under the background of sluggish overall income growth in the industry.

| What is the substantial impact of AI in specific business areas in the past year? | ||

| | Increase annual income | reduce annual costs |

| less than 5% | 27% | 28% |

| 5-10% | 21% | 21% |

| greater than 10% | 19% | 14% |

skill shortage is a major obstacle to the adoption and deployment of AI and generative AI.

Although remarkable results have been achieved, there are still many challenges hindering the wide application of AI and generative AI in the industry. The survey in 2023 shows that lack of skills or difficulty in recruiting suitable technical talents are the primary challenges for AI(34%) and generative AI(55%) applications. The second challenge is to build business cases with a clear Return on Investment (ROI). Overall, 33% of the respondents said it was difficult to quantify the ROI of AI.

It is worth noting that from 2022 to 2023, interviewees paid less attention to these two challenges. In 2022, 46% of the interviewees believed that the failure to quantify ROI was the biggest challenge, while 36% of the interviewees believed that the lack of sufficient data scientists was the main problem. These results show that in the past year, many companies have made great progress in how to deploy AI solutions and achieve value capture.

Other obstacles include technical challenges, such as weak technical infrastructure, insufficient data, data privacy issues, and budget constraints. It is worth noting that, in addition to network security, the attention of respondents to other challenges generally declined between 2022 and 2023. Concerns about network security have increased, which is understandable in the communications industry, because the industry operates key national infrastructure in many countries, at the same time, it faces the challenges of fraud and geopolitical factors.

| What are the major challenges your company faces in achieving AI goals? | ||

| | 2022 | 2023 |

| shortage of data scientists | 36% | 34% |

| difficult to quantify return on investment (ROI) | 46% | 33% |

| weak technical infrastructure | 33% | 30% |

| insufficient budget | 35% | 30% |

| data privacy issues | 30% | 26% |

| lack of data | 24% | 25% |

| network security issues | 17% | 20% |

| insufficient support from the senior management team | 11% | 4% |

AI investment

AI investment shows an increasing trend, but the overall level is still low.

As telecom companies deepen their commitment to AI and strive to overcome the challenges they face, AI investment is growing steadily. These investments mainly focus on AI infrastructure and models, aiming to help telecom companies transform traditional infrastructure into platforms that support AI, or solve specific business needs through AI.

According to the survey in 2023, 43% of the interviewees said that their investment in AI exceeded 1 million US dollars in 2022, and 52% of the interviewees reported the same investment scale in 2023, 66% of the respondents expect that the AI infrastructure budget will further increase in 2024. Compared with the survey results in 2022, these data show the continuous growth trend of AI investment.

However, AI investment is still at a relatively low level in general, indicating that the industry is still at an early stage of the investment cycle. However, in 2023, the proportion of respondents who reported an investment of more than 50 million US dollars increased by 4% to 7%, reflecting that telecom companies are strengthening the construction of AI infrastructure, to meet the needs of generative AI.

| How is your AI infrastructure budget expected to change in the coming year? | ||

| | 2022 | 2023 |

| add | 47% | 66% |

| remain Unchanged | 45% | 30% |

| reduce | 8% | 4% |

customer experience-related fields attract the highest proportion of AI investment

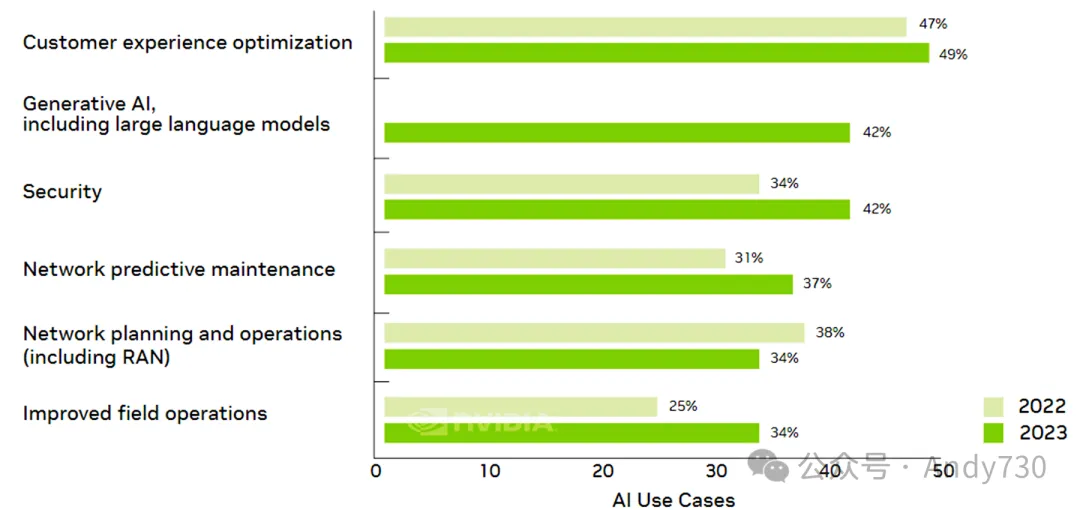

in 2023, customer experience optimization was still the most popular AI application scenario (49% of Respondents), which was similar to that in 2022 (47% of respondents). Especially in the aspect of generative AI, customer service and support have become the most popular investment fields, and 57% of the interviewees chose this direction. This is consistent with the interviewee's view that customer experience is regarded as the greatest AI opportunity.

In addition to customer experience, telecom companies also invest in other AI application scenarios. Security (42%), network predictive maintenance (37%), network planning and operation (34%), and on-site operation (34%) are other areas worthy of attention. It is worth noting that from 2022 to 2023, the application popularity of AI in transaction and payment fraud detection increased the fastest, increasing by 14 percent age points, reaching 28 percent of the interviewees.

The diversity of AI application scenarios in the telecommunications industry is also reflected in the survey results. Overall, 31% of the interviewees said they had invested in at least six AI application scenarios in 2023, while 40% of the interviewees planned to expand their investment to six or more application scenarios in 2024.

What key areas do you invest in AI?

The main driving force of AI investment: from pilot expansion to full deployment

with the deepening of AI cognition and the reduction of uncertainty (such as the return on investment), telecom companies are increasingly inclined to apply AI from Proof of Concept (PoC) and the pilot phase is extended to full deployment. For 50% of the interviewees who are investing in AI, this expansion is the main driving force for AI investment. At present, 41% of the interviewees have completed this transformation and entered the implementation stage.

In addition to expanding from PoC, economic uncertainty and other priority spending needs are also affecting decision-making. 32% of the interviewees mentioned concerns about the economic prospect. Similarly, 29% of the interviewees said that AI investment needs to keep a balance with the planned infrastructure upgrade expenditure, and 24% of the interviewees pointed out that market differentiation strategy is an important consideration for their AI investment decisions.

Comparing the survey results in 2023 and 2022, some key changes can be found. As the world gradually walks out of the impact of the epidemic, the impact of economic uncertainty has weakened. Similarly, the importance of infrastructure upgrading and market differentiation has also decreased, reflecting that AI is gradually being regarded as regular business needs rather than special business needs.

| What core factors will affect your company's AI investment decisions? | ||

| | 2022 | 2023 |

| from proof of concept (PoC) to production/scale deployment | 50% | 50% |

| economic uncertainty | 49% | 32% |

| infrastructure upgrade requirements | 49% | 29% |

| market differentiation strategy | 36% | 24% |

| data science priority adjustment | 22% | 13% |

implementation method

hybrid hosting is the preferred AI method, but cloud hosting is on the increase.

As AI has gradually become the mainstream technology of telecom companies, it is becoming of strategic significance to choose a platform to run AI. Currently, cloud hosting is becoming a trend, indicating that the demand for localized cloud infrastructure is increasing. In 2023, 31% of respondents said that most of their AI workloads were running on the cloud, compared with 21% in 2022.

In contrast, 25% of respondents run AI projects and workloads on local infrastructure, compared with 23% in 2022. Overall, the hybrid configuration of cloud and local infrastructure is still the mainstream hosting mode, although its popularity has declined. In 2023, 44% of the interviewees adopted the hybrid hosting mode, which is lower than 56% in 2022. Looking forward to 2024, 49% of the interviewees said they would continue to adopt hybrid mode, 33% chose cloud and 18% chose local deployment.

However, two insights suggest that these preferences may change in 2024. First, the current level of satisfaction is only at a medium level. Only 51% of respondents are satisfied with cloud hosting and 44% are satisfied with local hosting. Secondly, in terms of generative AI, 40% of the respondents prefer to deploy Large Language Models (LLMs) locally.

| Under what circumstances does your company currently or plan to run most AI projects or workloads? | ||

| | Current year | next year |

| cloud Deployment | 31% | 33% |

| local deployment | 25% | 18% |

| hybrid mode (cloud and local) | 44% | 49% |

partnerships remain crucial in the adoption of AI solutions

according to the survey in 2023, 44% of the interviewees said that cooperative development is the preferred way for their companies to develop AI solutions. 28% of the interviewees prefer to use open source tools, while 25% choose "AI as a Service"(AI-as-a-Service) mode.

Partnerships are critical to enhancing internal AI capabilities. Only 14 percent of the interviewees believe that their AI capabilities are in the leading position in the industry, while 32 percent worry that they are in a backward state in the industry. Therefore, seeking cooperation with third parties to accelerate the adoption of AI has become the top priority of interviewees in AI technology investment. The partnership also creates opportunities for telecom companies to provide customers with new services and expand rapidly at lower investment costs. 49% of the respondents said they developed AI solutions for internal and external users.

However, in some cases, the preference for cooperation is more complicated. For generative AI,40% of the interviewees train AI models through their own data to enhance existing solutions, while only 29% of the interviewees choose to build or customize models with their partners. This option is understandable in the telecommunications industry because the industry has strict data protection regulations.

| What model does your company use to develop AI solutions? | ||

| | 2022 | 2023 |

| develop with partners | 49% | 44% |

| use open source tools | 33% | 28% |

| self-developed | 31% | 27% |

| AI as a Service (AI-as-a-Service) | 32% | 25% |

| data science modeling tool | 35% | 19% |

| automated Machine Learning | 28% | 19% |

| enterprise software | 22% | 15% |

| outsourcing | 25% | 12% |

looking forward to the future

the role of AI in the telecommunications industry is deepening. Last year's "current situation of AI in telecom industry" report confirmed for the first time the status of AI in telecom industry and its changing key areas. Since then, with the emergence of generative AI, AI's influence in the whole society and the world's leading industries has further increased. According to industry insights from this survey, the status and impact of AI are obviously accelerating.

For telecom companies, it is very important to adopt AI, because AI is an important force to promote technological innovation, create new products and services, modernize infrastructure, improve operational efficiency and bring profits to industry stakeholders. For an industry that provides key infrastructure and services for enterprises and consumer industries, AI enables telecommunications companies to provide connectivity to global communication and online services in a sustainable and efficient manner.

With the growth of adoption rate, AI, especially generative AI, will gradually become the core part of the telecom industry technology and investment roadmap. AI will become the core technology of the next generation cellular network, helping the industry realize its expectations for 5G and deliver powerful new applications and services. This also enables telecom companies to obtain returns from large investments in capital expenditures, Spectrum, deployment and maintenance.

references: NVIDIA. (2024, October). State of AI in Telecommunications: 2024 Trends. Survey Report. Retrieved from https://resources.nvidia.com/en-us-ai-in-telco/state-of-ai-in-telco-2024-report.

---[This article is finished]] ---

source: Andy730

Reprint

Reprint