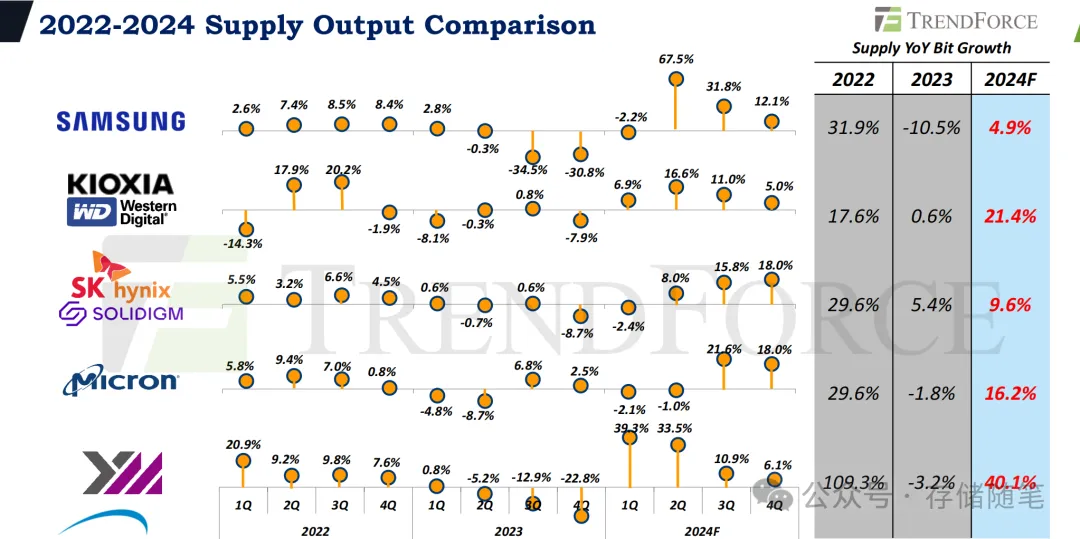

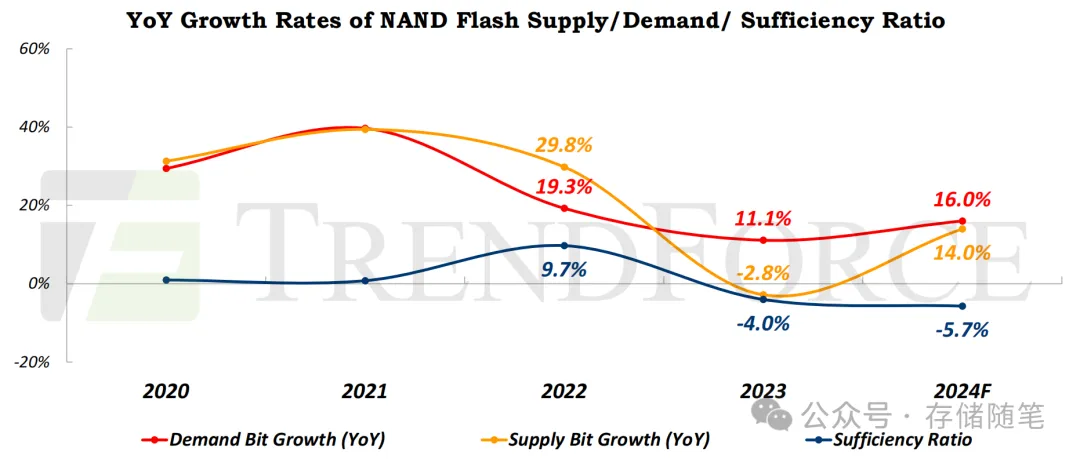

Judging from the market supply situation from 2022 to 2024, the bit growth of NAND flash memory is fluctuating. From 2022 to 2024, the NAND flash memory market experienced a positive growth trend, but the growth rate fluctuated. This fluctuation may reflect the changes in the relationship between supply and demand in the market and the differences in competition strategies among various manufacturers.

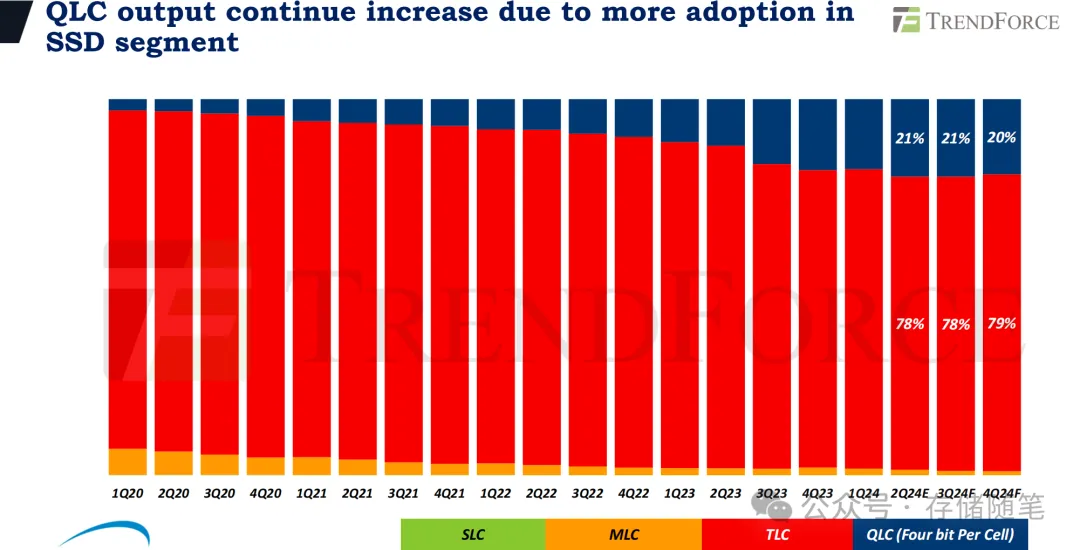

According to TrendForce's research, the use of QLC NAND flash memory in the field of solid state drives continued to increase from 2020 to 2024, resulting in a continuous increase in its output. The main reason behind this phenomenon is that QLC technology can provide higher storage density than traditional TLC, MLC and SLC technologies. In other words, chips of the same size can store more data, thus reducing the cost per GB.

The advantage of QLC NAND is that it can store four bits of information in each unit, which means that compared with SLC, it can store four times the amount of data in the same physical space. However, QLC also has some disadvantages, such as its durability is not as good as SLC or MLC, its write speed may be slow, and its performance may decline after a large number of write operations.

Despite these shortcomings, with the progress of technology, these problems have been alleviated, making QLC NAND a choice for many consumer SSDs, especially in cost-sensitive application scenarios. As QLC technology matures, it is expected to occupy a larger share in the SSD market, especially in application scenarios that do not require the highest performance or maximum time durability. Therefore, as more SSDs using QLC NAND enter the market, the output of QLC is expected to continue to grow.

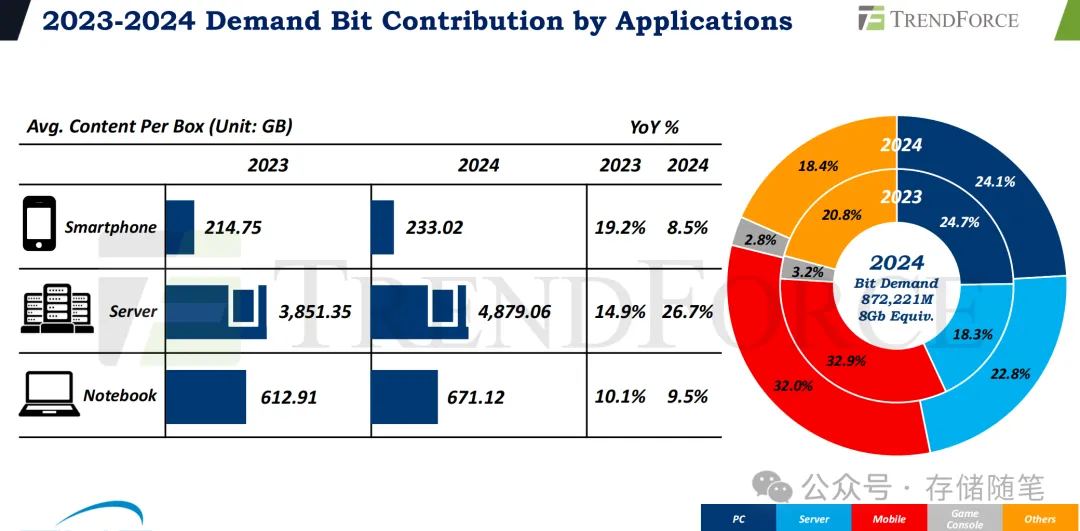

From 2023 to, in the application field of NAND flash memory, game consoles, PCs, servers, mobile devices and other applications all contributed to NAND bit requirements. Among them, with the development of artificial intelligence applications, the demand for high-capacity storage products such as 16TB increases, while at the same time, the average NAND capacity in mobile phones and PCs is still less than 1TB. This shows that although the market demand for high-capacity storage products is increasing, the storage capacity of mainstream consumer electronic devices is increasing relatively slowly.

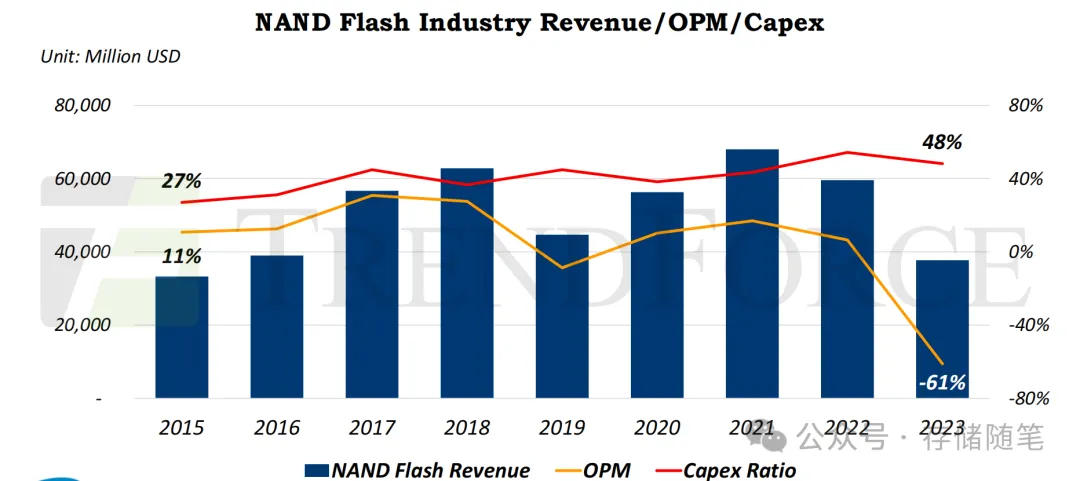

From 2020 to 2020, the ratio of revenue to operating profit (OPM) and capital expenditure (Capex) of NAND flash memory industry is shown in the chart. It can be seen that the industry income shows an upward trend, but OPM fluctuates greatly, indicating that although the overall scale of the industry expands, its profitability is affected by many factors. At the same time, the change of capital expenditure ratio also reflects the degree of investment of various manufacturers in technological upgrading.

Future challenges

-

cost competitiveness: With the improvement of technology, the required capital investment increases rapidly and the space for cost optimization shrinks. How to maintain cost competitiveness while avoiding excess market supply has become an important issue.

-

High capacity storage: AI applications drive the demand for large-capacity storage devices, but the storage level of mainstream devices is still relatively low. Suppliers need to flexibly adjust production to meet different product requirements.

-

Market demand: whether AI applications can drive the increase of NAND consumption in PC and mobile devices is still uncertain, which will be a key point affecting the future development of NAND industry.

References: FMS 2024-TrendForce-Future Challenge and Opportunity for NAND Industry

Reprint

Reprint